SBI offers a Net Banking Facility with every savings account. The SBI Netbanking Facility gives you the freedom to take care of a lot of your banking needs from the comfort of your home.

With SBI Net Banking, you can view your account balance, open a fixed or recurring deposit account, transfer funds to other accounts, pay bills or apply for an IPO – all at the click of a button.

If you wish to know how to activate Net Banking on your SBI Savings Account, you can refer to my guide on Activating SBI Netbanking.

In this post I will discuss how you can Open a Fixed Deposit Account using SBI Netbanking.

Steps to Open a FD Account using SBI Netbanking.

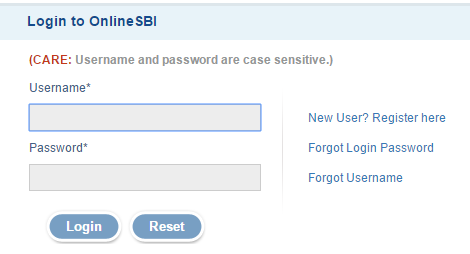

Step 1: Log into to your SBI Netbanking Account using the following link: https://retail.onlinesbi.com/retail/login.htm

Steps to Open a FD Account using SBI Netbanking.

Step 1: Log into to your SBI Netbanking Account using the following link: https://retail.onlinesbi.com/retail/login.htm

Step 2: On the page that opens up, click on the ‘e-Fixed Deposit‘ Tab.

Step 3: Next, select the type of FD account you wish to Open and then click on ‘Proceed‘.

The e-TDR/e-STDR (Fixed Deposit) is your traditional FD Account.

The MOD (Multi Option Deposit) account is a combination of your Savings account and Fixed Deposit account. These are similar to any other Fixed Deposits but at the time of need for funds, withdrawals from the deposits can be made by issuing a cheque from Savings Bank Account or from ATM / branch or through any other channel – without having to make a pre-mature withdrawal of the entire FD amount. Thus, MOD deposits are more liquid than your traditional Fixed Deposit Account and since the interest rates are the same whether for a Traditional FD Account or a MOD Account, it is always better to go for an MOD Account.

You can also open a 5 year FD under the ‘Income Tax Saving Scheme’ using your SBI NetBanking Account.

Step 4: On the page that opens up, you are required to input the following details:

A. Amount of your FD

B. The Timing of Interest Credit i.e at selected intervals (Monthly or Quarterly) or at maturity.

C. The Tenure of your FD.

Once you have entered the details as required above, click on the “I accept the Terms and Conditions” box and the click on the “Submit” button.

Step 5: On the page that opens up you will be required to to verify the details you have entered above. Once you click on ‘Confirm‘ your e-FD account will be opened. You will see a confirmation screen once your FD gets opened and you will also get an option download the FD certificate.

Thanks for your time. Happy Investing.